- « Previous Page

- 1

- …

- 89

- 90

- 91

- 92

- 93

- …

- 152

- Next Page »

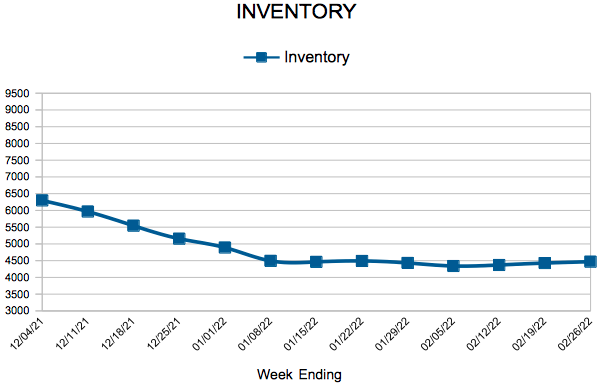

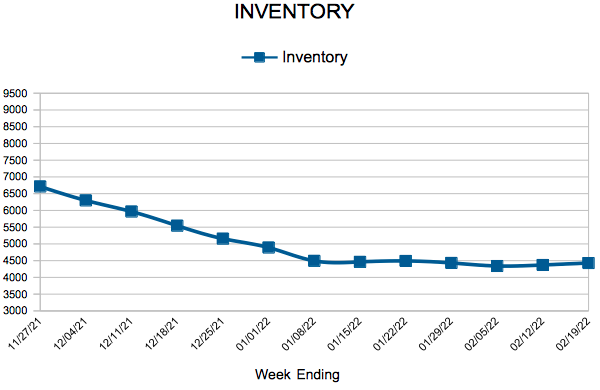

Inventory

Weekly Market Report

For Week Ending February 26, 2022

For Week Ending February 26, 2022

Nationally, pending home sales decreased 5.7% as of last measure, marking the third consecutive month of declines according to the National Association of REALTORS®. With housing supply at a record low, buyers are finding fewer and fewer homes for sale, while rising mortgage rates and increased housing costs have priced out marginal buyers. Inventory levels are expected to improve gradually as the weather warms; in the meantime, economists say buyers should expect a challenging spring market.

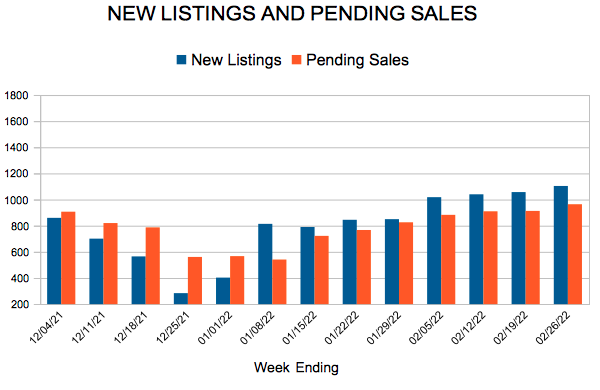

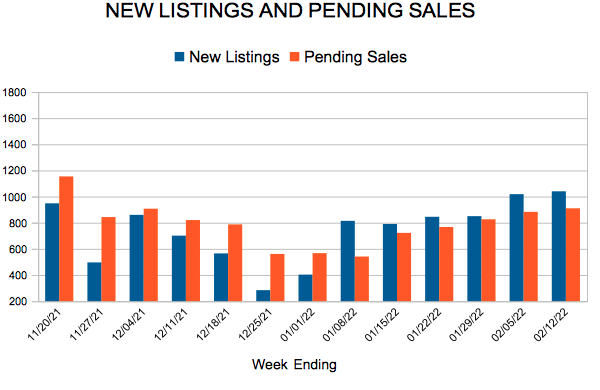

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 26:

- New Listings decreased 12.7% to 1,104

- Pending Sales decreased 15.1% to 964

- Inventory decreased 16.9% to 4,469

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $333,000

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

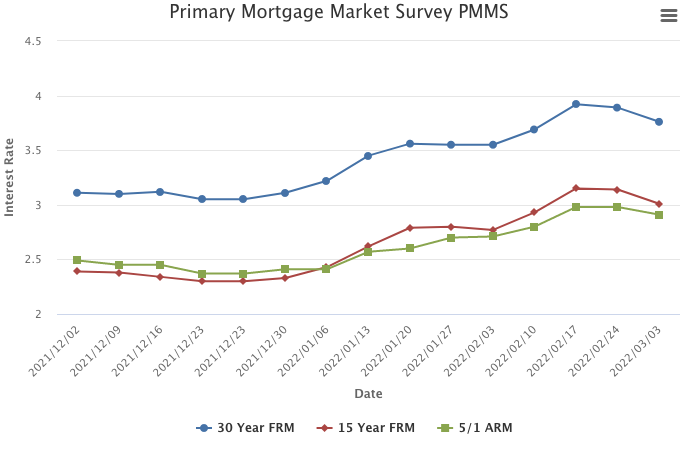

Mortgage Rates Fall

March 3, 2022

Geopolitical tensions caused U.S. Treasury yields to recede this week as investors moved to the safety of bonds, leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending February 19, 2022

For Week Ending February 19, 2022

Median rental prices have increased by double-digits for eight consecutive months, rising 19.8% year-over-year. While home prices continue to climb, according to Realtor.com’s January Rental Report, buying a starter home is more affordable than renting a similar sized apartment in more than half of the nation’s largest metropolitan areas. That’s because, nationally, rent growth is rising faster than home prices, with economists expecting rental prices to outpace listing price growth in 2022.

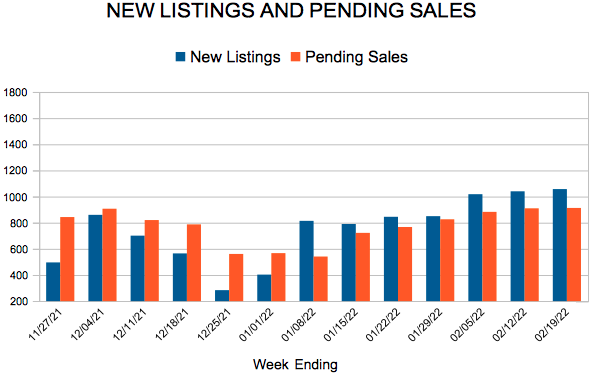

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 19:

- New Listings decreased 3.0% to 1,057

- Pending Sales decreased 11.0% to 913

- Inventory decreased 19.2% to 4,429

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $333,000

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decrease Slightly

February 24, 2022

Even with this week’s decline, mortgage rates have increased more than a full percent over the last six months. Overall economic growth remains strong, but rising inflation is already impacting consumer sentiment, which has markedly declined in recent months. As we enter the spring homebuying season with higher mortgage rates and continued low inventory, we expect home price growth to remain firm before cooling off later this year.

Information provided by Freddie Mac.

January Monthly Skinny Video

For many buyers, 2022 marks a new opportunity to make their home purchase dreams a reality. But it won’t be without its challenges.

Inventory of existing homes was at 910,000 at the start of the new year, the lowest level recorded since 1999, and competition remains fierce.

Pending Sales decreased 13.0 percent from January 2021 to 3,122 for the month. Closed Sales decreased 16.7 percent from January 2021 to 2,810 for the month. Inventory levels market-wide decreased 30.1 percent to 3,894 units.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 89

- 90

- 91

- 92

- 93

- …

- 152

- Next Page »