For Week Ending July 11, 2015

With the economy on the ups these days, the Federal Reserve Chair, Janet Yellen, is predicting a fine-tuning of monetary policy by the end of the year. In tandem with the improving economy, the unemployment rate dropped by 0.2 percent to 5.3 percent for June 2015. It is widely believed that interest rates will go up before the year is over, which is a pretty clear indicator that the housing market is thrumming along at a good clip.

In the Twin Cities region, for the week ending July 11:

- New Listings increased 2.7% to 2,143

- Pending Sales increased 7.5% to 1,310

- Inventory decreased 9.0% to 16,655

For the month of June:

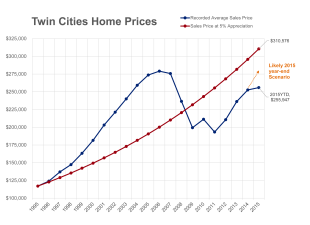

- Median Sales Price increased 4.7% to $229,900

- Days on Market decreased 5.7% to 66

- Percent of Original List Price Received increased 0.5% to 97.7%

- Months Supply of Inventory decreased 15.9% to 3.7

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.