- « Previous Page

- 1

- …

- 52

- 53

- 54

- 55

- 56

- …

- 152

- Next Page »

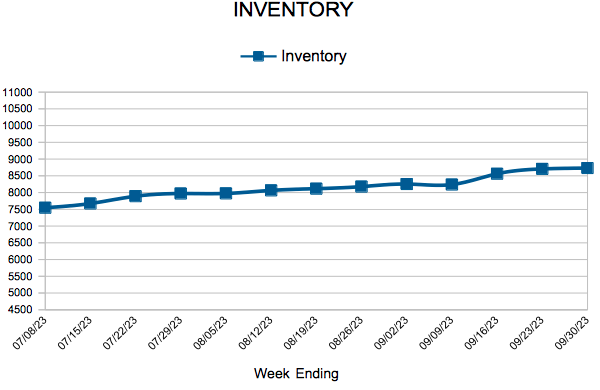

Inventory

Weekly Market Report

For Week Ending September 30, 2023

For Week Ending September 30, 2023

Nationally, pending home sales decreased 7.1% month-over-month as of last measure, falling to the lowest level since April 2020, according to the National Association of REALTORS®, as rising borrowing costs and a scarcity of new listings continue to impact market activity. Pending sales declined in all four regions and were down 18.7% year-over-year, with the smallest monthly declines noted in the Northeast (-0.9%) and the Midwest (-7.0%).

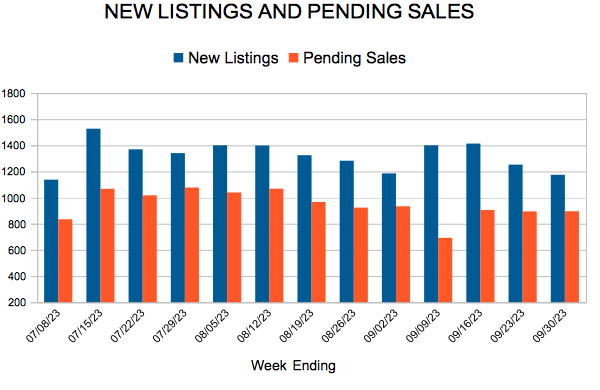

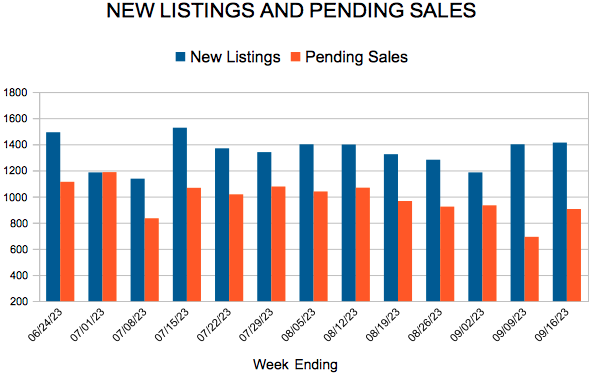

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 30:

- New Listings decreased 9.8% to 1,174

- Pending Sales decreased 2.0% to 895

- Inventory decreased 7.4% to 8,732

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

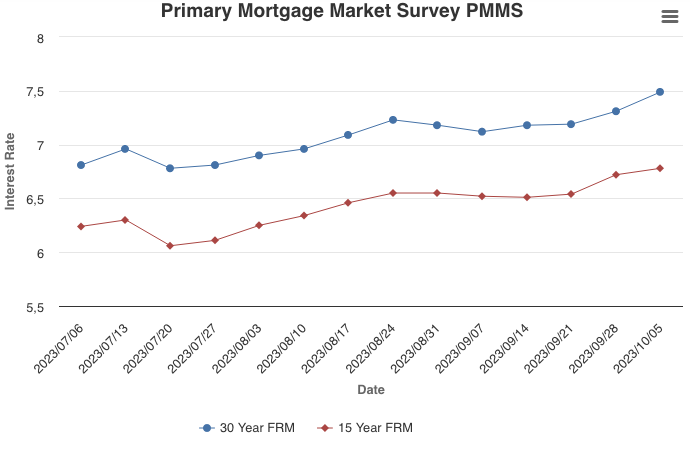

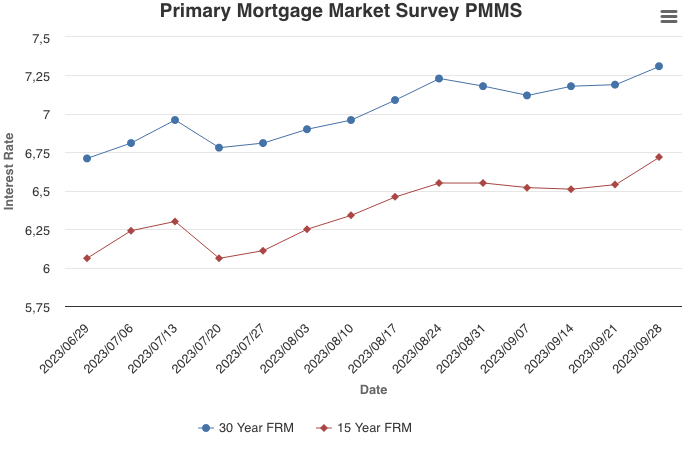

Mortgage Rates Continue to Surge

October 5, 2023

Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed. Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.

Information provided by Freddie Mac.

New Listings and Pending Sales

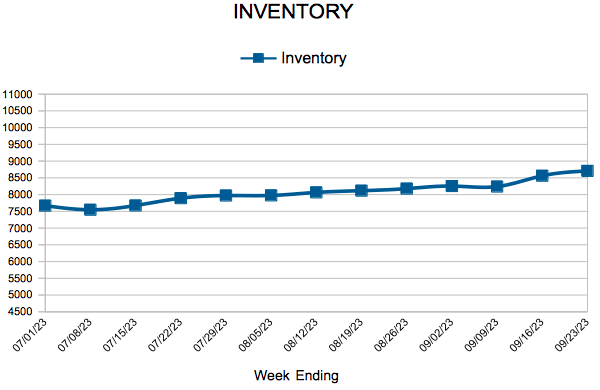

Inventory

Weekly Market Report

For Week Ending September 23, 2023

For Week Ending September 23, 2023

New-home construction recently fell to a 3-year low, as higher mortgage rates take their toll on homebuilders, impacting affordability and causing production to slow. According to the U.S. Census Bureau, housing starts dropped 11.3% from the previous month, led by a decline in multi-family construction. Although starts fell more than economists predicted, building permits increased over the same period, rising 6.9% from the previous month.

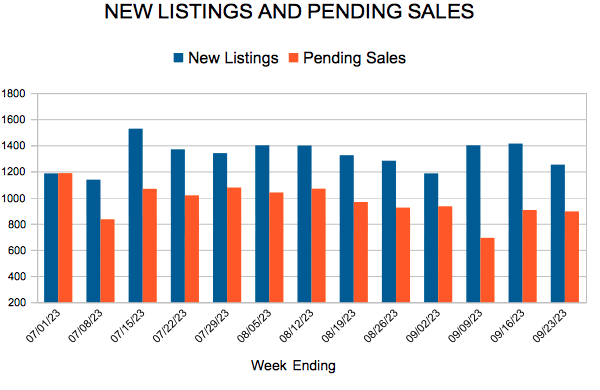

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 23:

- New Listings decreased 3.8% to 1,252

- Pending Sales decreased 10.0% to 894

- Inventory decreased 8.7% to 8,707

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Reach Highest Level in Almost 23 Years

September 28, 2023

The 30-year fixed-rate mortgage has hit the highest level since the year 2000. However, unlike the turn of the millennium, house prices today are rising alongside mortgage rates, primarily due to low inventory. These headwinds are causing both buyers and sellers to hold out for better circumstances.

Information provided by Freddie Mac.

August Monthly Skinny Video

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 52

- 53

- 54

- 55

- 56

- …

- 152

- Next Page »