For Week Ending October 24, 2015

Data analysis from September national numbers revealed that new home sales underperformed slightly from what was originally expected. Some say this indicates market cooling, but with October giving way to November, it means we will soon have another month of sales to prove or disprove naysayers.

In the Twin Cities region, for the week ending October 24:

- New Listings decreased 2.5% to 1,233

- Pending Sales increased 10.7% to 934

- Inventory decreased 15.7% to 15,650

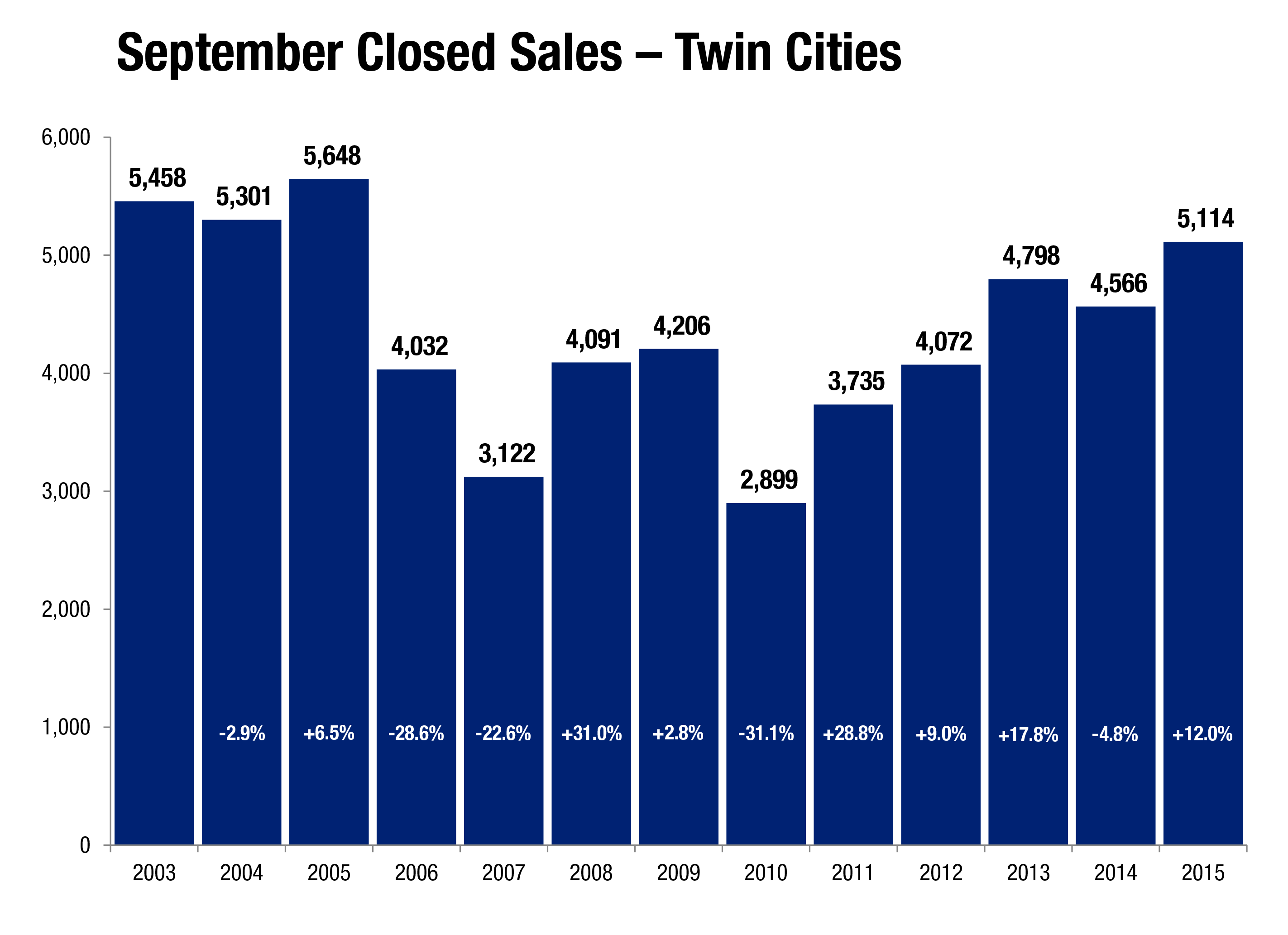

For the month of September:

- Median Sales Price increased 8.1% to $221,650

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 23.9% to 3.5

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.