- « Previous Page

- 1

- …

- 99

- 100

- 101

- 102

- 103

- …

- 151

- Next Page »

Inventory

Weekly Market Report

For Week Ending August 28, 2021

For Week Ending August 28, 2021

Pending sales were down for a second straight month, falling 1.8% in July, according to the National Association of REALTORS®, as stiff competition for homes and high sales prices have discouraged some would-be buyers. Home prices have been soaring during the pandemic, with the S&P Corelogic Case-Shiller national home price index reporting that prices rose 18.6% nationally in June, the largest annual increase in the history of the index since 1987.

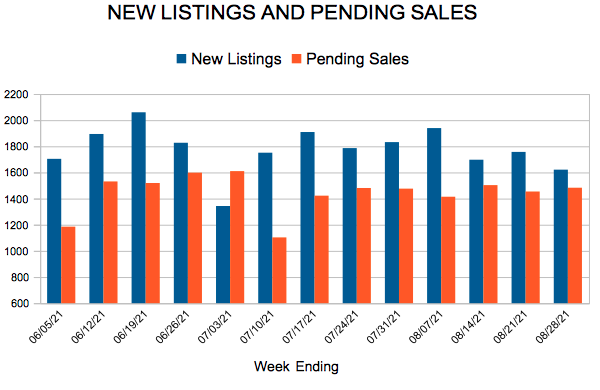

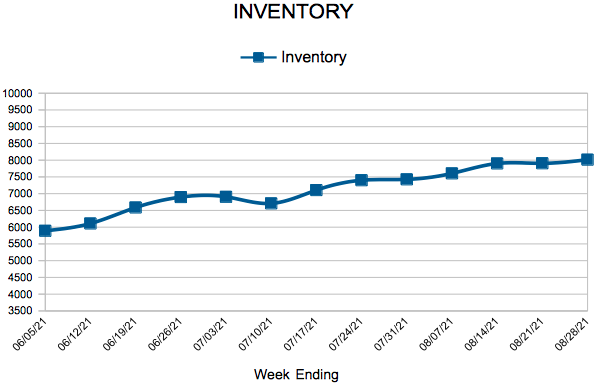

In the Twin Cities region, for the week ending August 28:

- New Listings decreased 10.6% to 1,621

- Pending Sales decreased 8.6% to 1,463

- Inventory decreased 17.8% to 8,014

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

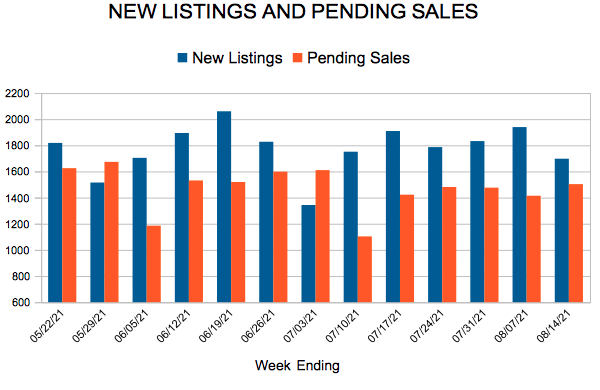

New Listings and Pending Sales

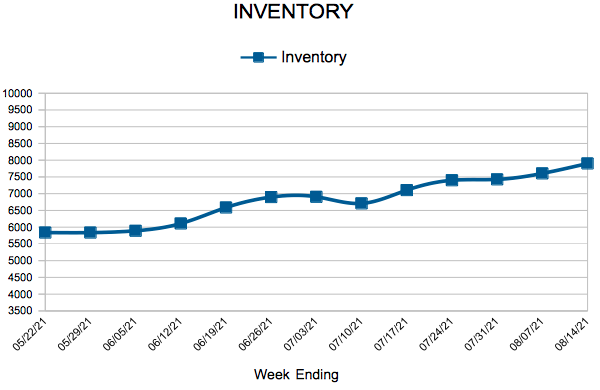

Inventory

Weekly Market Report

For Week Ending August 21, 2021

For Week Ending August 21, 2021

With the last days of summer on the horizon, experts are expecting an unusually busy fall market, as sellers continue putting more homes on the market, hoping to take advantage of record-high sales prices and strong buyer demand. The National Association of REALTORS® reports the median existing home price was up 17.8% year-over-year, and new listings were up 7.3% in July compared to June, defying seasonality trends typically seen in the fall.

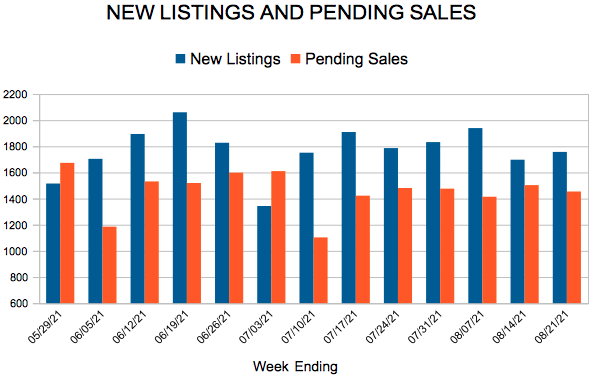

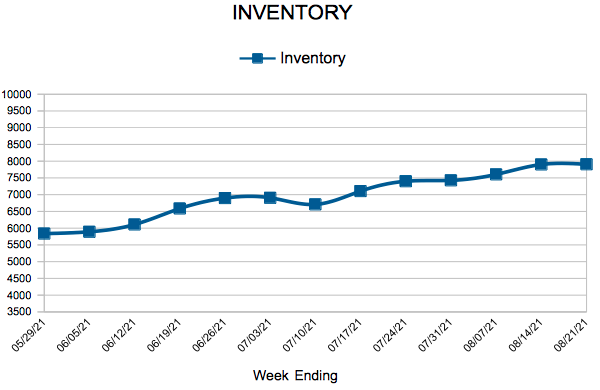

In the Twin Cities region, for the week ending August 21:

- New Listings decreased 5.0% to 1,757

- Pending Sales decreased 11.0% to 1,454

- Inventory decreased 19.5% to 7,906

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

July Monthly Skinny Video

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 14, 2021

For Week Ending August 14, 2021

High home prices are the most common reason prospective buyers have yet to purchase a home, with 39% of active buyers mentioning high sales prices as the primary deterrent to not finding a home in Q2 2021, according to a recent Housing Trends report from the National Association of Home Builders. This is a change from the previous two quarters, where interested buyers reported being outbid by other offers as the most common reason for not purchasing a home.

In the Twin Cities region, for the week ending August 14:

- New Listings decreased 11.7% to 1,697

- Pending Sales decreased 8.0% to 1,503

- Inventory decreased 19.3% to 7,901

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 99

- 100

- 101

- 102

- 103

- …

- 151

- Next Page »