For Week Ending August 24, 2024

For Week Ending August 24, 2024

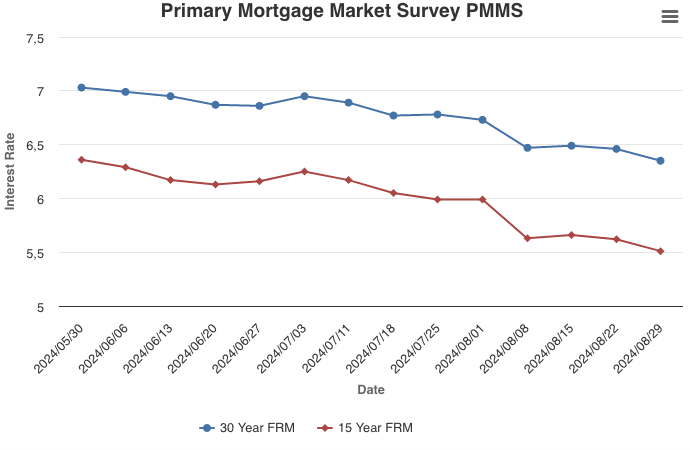

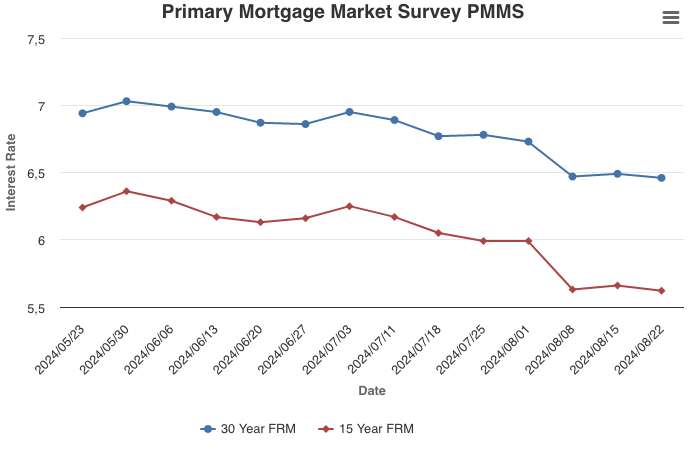

U.S. housing starts fell 6.8% month-over-month and 16.0% year-over-year to a seasonally adjusted annual rate of 1,238,000 units, according to the U.S. Census Bureau. Building permits also declined as of last measure, sliding 4% month-over-month to a seasonally adjusted annual rate of 1,396,000 units. Analysts say Hurricane Beryl, along with elevated interest rates in July, likely impacted construction activity.

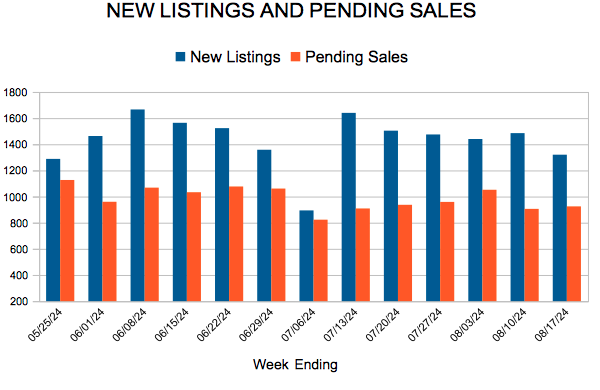

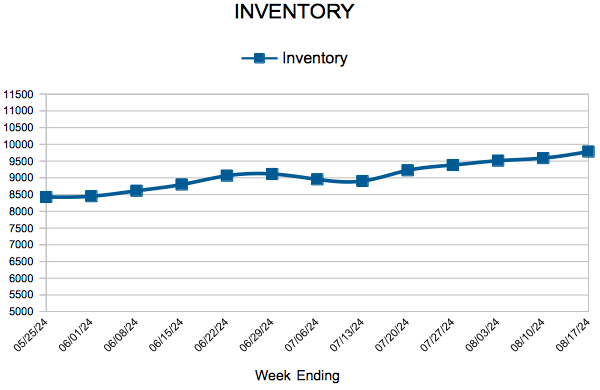

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 24:

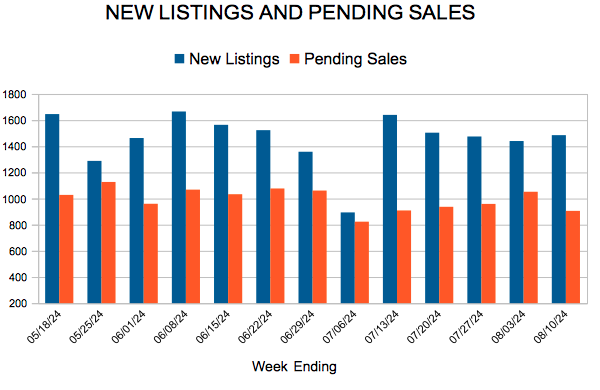

- New Listings decreased 3.9% to 1,268

- Pending Sales decreased 9.2% to 845

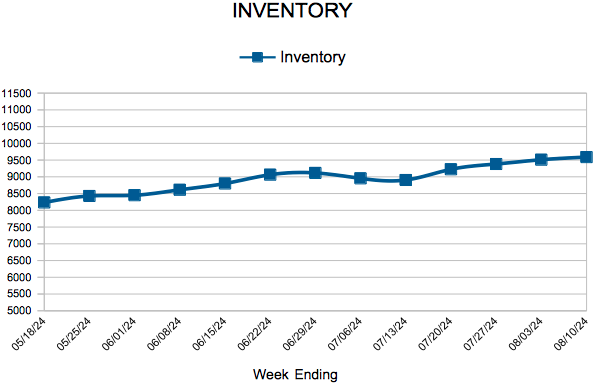

- Inventory increased 13.6% to 9,793

FOR THE MONTH OF JULY:

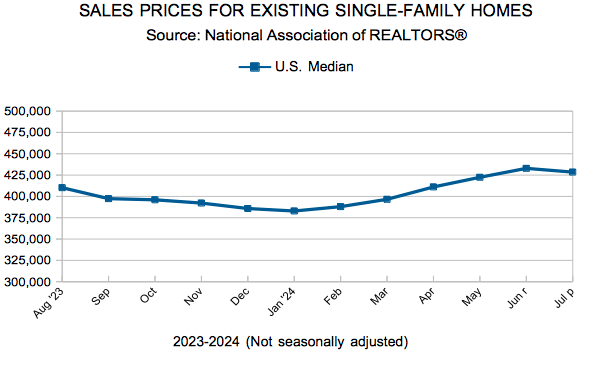

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.1% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.