December 11, 2025

The average 30-year fixed-rate mortgage is well below the year-to-date average of 6.62%, providing some sense of balance to the housing market.

- The 30-year fixed-rate mortgage averaged 6.22% as of December 11, 2025, up from last week when it averaged 6.19%. A year ago at this time, the 30-year FRM averaged 6.60%.

- The 15-year fixed-rate mortgage averaged 5.54%, up from last week when it averaged 5.44%. A year ago at this time, the 15-year FRM averaged 5.84%.

Information provided by Freddie Mac.

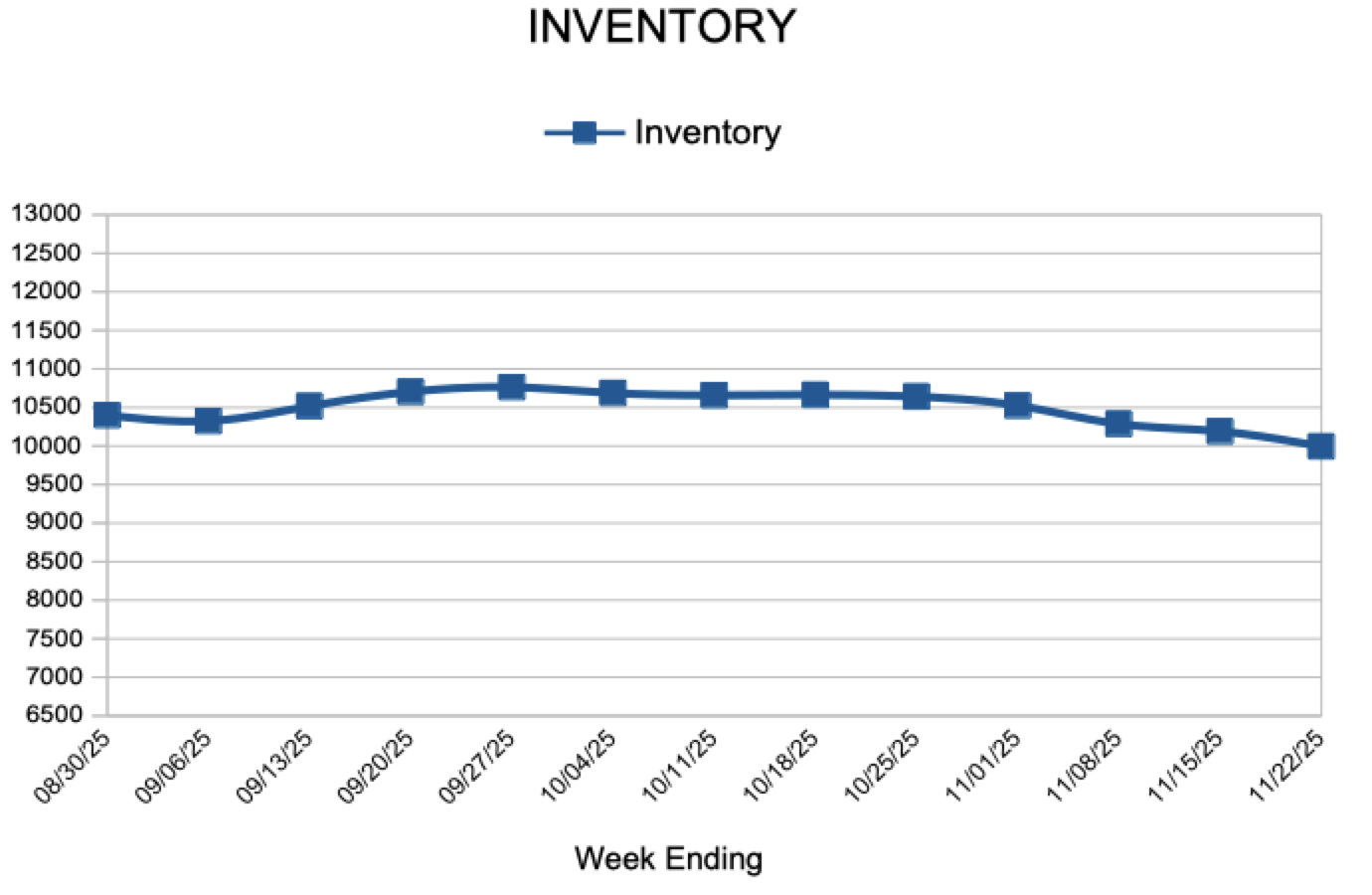

For Week Ending November 29, 2025

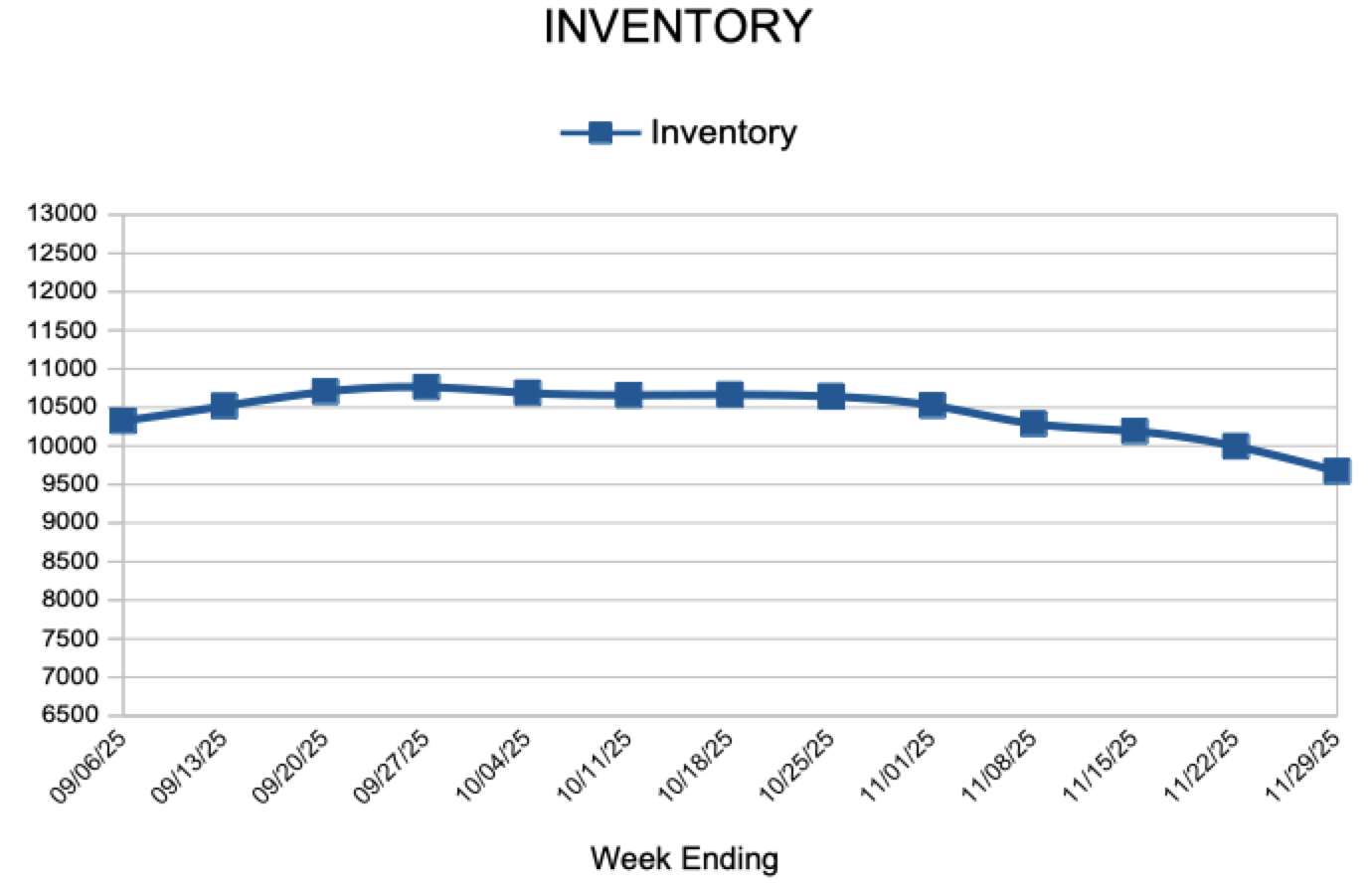

For Week Ending November 29, 2025